I’m Guy Kawasaki, and this is Remarkable People. We’re on a mission to make you remarkable.

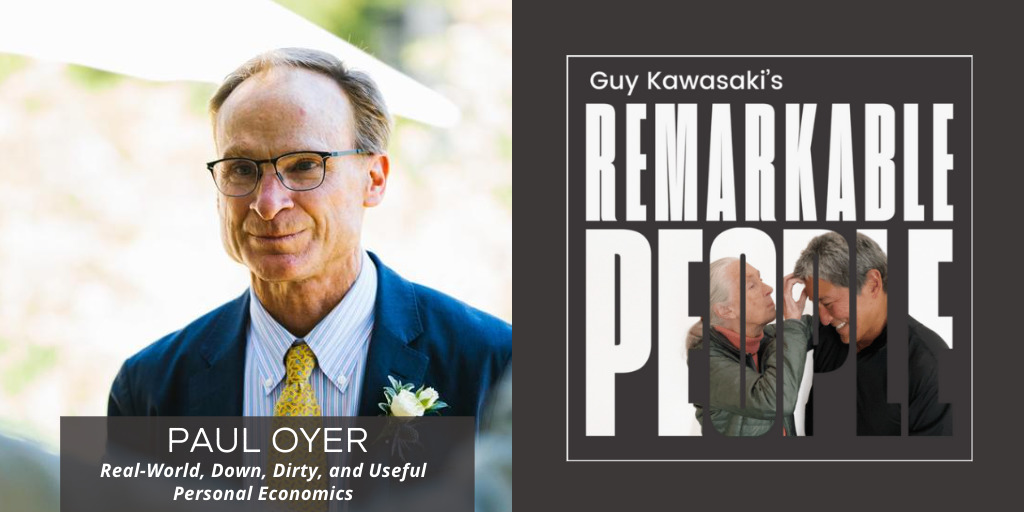

Helping me in this episode is the remarkable Paul Oyer. He is a professor of Economics at the Stanford Graduate School of Business and the Editor-in-Chief of the Journal of Labor Economics.

Paul obtained his bachelor’s in math and computer science from Middlebury College. He holds an MBA from Yale University, and an MA and Ph.D. in economics from Princeton University.

Paul is the coauthor of The Roadside MBA and the author of Everything I Ever Needed to Know about Economics I Learned from Online Dating.

His latest book is, An Economist Goes to the Game: How to Throw Away $580 Million and Other Surprising Insights from the Economics of Sports.

In the next hour, you’re going to learn how to look at these topics through the lens of “personal economics:”

- The online dating market

- The gig economy vs. a “permanent” position

- Professional sports

- The unpredictable effects of increasing the minimum wage

- Whether it’s better to quit or be laid off

Please enjoy this remarkable episode with Paul Oyer!

If you enjoyed this episode of the Remarkable People podcast, please leave a rating, write a review, and subscribe. Thank you!

Transcript of Guy Kawasaki’s Remarkable People podcast with Paul Oyer

Guy Kawasaki:

I'm Guy Kawasaki and this is Remarkable People. We are on a mission to make you remarkable.

Helping me in this episode is the remarkable Paul Oyer.

He is a professor of economics at the Stanford Graduate School of Business and the editor-in-chief of the Journal of Labor Economics.

Paul obtained his bachelor's in math and computer science from Middlebury College. He holds an MBA from Yale University, and an MA and PhD in economics from Princeton University.

Paul is the co-author of The Roadside MBA and the author of Everything I Ever Needed to Know about Economics I Learned from Online Dating. His latest book is called An Economist Goes to the Game: How to Throw Away $580 Million and Other Surprising Insights from the Economics of Sports.

In the next hour, you're going to learn how to look at these topics through the lens of personal economics, the online dating market, the gig economy versus permanent positions, professional sports, the unpredictable effects of increasing the minimum wage and whether it's better to get laid off or quit.

I'm Guy Kawasaki. This is Remarkable People. And now here's the remarkable Paul Oyer.

In many parts of your writing and just writing in general in business books, I want to know how researchers truly know "that something is causal as opposed to Post hoc ergo propter hoc?"

For example, when you say, I don't know if I'm paraphrasing you, so maybe you're going to correct me, but if you say the reason why there's so many great tennis players in Poland is because of Martina Navratilova, and the reason why there's a lot of great golfers in South Korea is because in South Korea women's careers are stifled, so they found this avenue. So how do you know that that's because of this as opposed to simply after this?

Paul Oyer:

Yeah, that's a great question. The book is an illustration of economics applied to sports. It's very different from if I was writing a peer-reviewed paper. So if I was writing a peer-reviewed paper, I'd be really careful about the causality questions you asked.

And in the book I review a lot of peer-reviewed papers that were very careful about that. I'll come back to some of those in a second. I would say that the chapter on nations being dominant in certain sports that is definitely more of a narrative than a scientific study. And I want to be very upfront about that.

I think the examples you gave are fantastic. So the story fits together of Martina Navratilova and the Soviet influence during the tennis era, leading to the dominance of Czech women tennis players. And I think that the Korean example is maybe even my all-time favorite.

I describe in the book this perfect storm that leads to the South Korean women being as dominant as they are. But to be honest, I haven't seen a good scientific study that says we can provide some causal link.

And I can't even think of how you would do that in that case because in order to do something like that, you'd need some random variation in what caused something to start. And you can't randomly assign snow to Norway or you don't randomly assign a high gender gap to South Korea.

So I think that's a great question and I'm not going to be defensive about it. I'll just say up front that particular chapter is a narrative of applying economic logic.

It's not a scientific conclusion that we can be so sure that there was a causal relationship between the gender gap and the dominance of women in Korean golf.

Guy Kawasaki:

Okay, thank you. People who are listening saying, "Guy said that Martina Navratilova was from Poland, not Czech Republic." I'm going to get thousands of people correcting me. So I just want to acknowledge that I blew it, okay?

Paul Oyer:

Well, in fairness, Iga Świątek is from Poland and is dominating women's tennis as we speak. So having Poland on the top of mind for women's tennis makes sense.

Guy Kawasaki:

So if people are listening to this and they say, Steve Jobs was adopted. Maybe if we want our son or daughter to be the next Steve Jobs.

We should put him or her up for adoption." And although you could make the case that being adopted could have a psychological impact that would drive you to be a Steve Jobs, but that's not necessarily the primary cause, right?

Paul Oyer:

Right. That's a really good example. And the distinction, I'll draw between that and the Steve Jobs thing is in the book, what I'm doing with the Korean women is laying out an economic model and framework that would lead to the conclusions that we get.

A lot of economists are theorists and they draw those sorts of conclusions all the time rather than doing scientific studies of what's causing what. But there's an underlying framework that says, here's a bunch of economic ideas that would lead to concluding that these are what led Korean women to be so good at golf.

There's not really a good underlying framework that says being adopted is going to lead to success.

Let me give you a better example, maybe with Steve Jobs, and that is he was a college dropout, right? And you might look at that and you might mistake correlation with causation and say, "Steve Jobs dropped out of college, therefore I hope my kid will drop out of college."

First of all, there's a lack of a good framework there because it doesn't make much sense. But even so, we have so many great scientific studies on the causal link between college and success later in life, and what we can scientifically and conclusively say is that a dropout who was successful as Steve Jobs is a scientific anomaly; it's not something that one could attribute to having dropped out.

Guy Kawasaki:

Well, Steve Jobs is a scientific anomaly in general, in my humble opinion.

Every night on CNBC experts explain why the market went up or down that day. And so my conclusion after what you just told me and reading your books is that basically they're full of shit.

If they really knew, they would make the prediction and they would make their investments in the morning as opposed to in the evening. So what do we make of the CNBC, MSNBC experts every night to explain what happened during the day?

Paul Oyer:

That's a great question. And I think sometimes some of them are full of it and just making up explanations that have no underlying framework or way of being useful. But let me put a more positive spin on it. And I don't think this applies to every CNBC analyst. But one way you can look at it is they can help see the pattern that day and it's one data point.

It's not a story that's going to work every day, but it's a data point that says, "Oh, the jobs report did this or that, and we can see something." And if you're watching this and you're trying to beat the market, that might help you get prepared for the next time.

And so it's not necessarily any one day, you can't learn enough to make a broad conclusion, but if you watch CNBC enough and you see the patterns, you might be able to be prepared for things as they come. I think that's a more positive spin on what you said.

Guy Kawasaki:

I majored in psych at Stanford, but if I could do it all over again, I would major in behavioral economics. I just love behavioral economics and I love psychology.

Now would you say that economics or psychology, are they basically thick economies or are they a conglomeration of a lot of thin economies?

Like you take labor economics, you add to agricultural economics, you add it to, I don't know, sports economics. What is it? Is it one big thing or is it a bunch of little things conglomerated?

Paul Oyer:

You mean economics?

Guy Kawasaki:

Economics or psychology, yeah.

Paul Oyer:

So psychology I won't speak for. I'll let you as the psych major because having an undergraduate degree in psychology puts you way ahead of me in your knowledge in psychology.

Remember, academics, we tend to be pretty narrow, not all of us, but economists tend to be pretty narrow. We're focused on economics.

And so I would say within economics, I think there's one underlying science, maybe two if you think about micro and macro because they're very different from each other, but otherwise they're just applications of the same ideas.

So sports economics is almost always, at least the way I wrote it, is just applications of bigger ideas in microeconomics to the sports context. Labor economics is the same.

Before I wrote the sports book a number of years ago, I wrote a book, Applying Economics to the World of Online Dating. Online dating, believe it or not, or the marriage market, that's economics. It's not just economics.

Psychology plays a huge role in those areas as well, obviously. But the economics of families and matching with significant others is very similar to a lot of other microeconomic contexts, which is maybe hard for non-economists to see. But as a labor economist, the parallels are really quite dramatic.

The matching of employees to firms is from an economic perspective, very similar to the matching of one set of people to another set in terms of marriages or relationships.

Guy Kawasaki:

Can you go Stephen Wolfram or Neil deGrasse Tyson on me and just say... because I believe this is possible and you can do it? Are there basically four or five economic principles that apply to agriculture, labor, sports, whatever? Just give me the holy grail here.

Paul Oyer:

First of all, you've tried to put me in the company of giants. I'm not sure I can quite live up to the standards you shot for there.

I'll give you a couple of the biggest ideas of economics that apply in all of these concepts, and if you get on Twitter and ask what are the big ideas in economics, these are the things people will get excited about.

I think the first one, and it really comes back to that idea about the chapter in my sports book about Norwegian cross-country skiers and women playing golf in Korea.

One of the biggest ideas in economics and applies in every field you just said is a comparative advantage, sometimes a natural advantage, but just in general, there's something you are good at and there's something else I'm good at, and as a world we're much better off if I concentrate on the thing I'm good at, you concentrate on the thing you're good at, and we trade.

Take Canada, for example, it produces a lot of oil and other minerals because they have the stuff there and it just makes sense. And rather than them trying to make rice at the same time, which is very difficult to do in Canada, they make oil and then they trade rice with Thailand or China or whatever country.

So that idea, I just explained how it applies in agriculture, it certainly makes sense. It certainly applies in sports in the way I mentioned. That's why we want to watch Norwegian cross-country skiers and Florida golfers because as fans it's better to watch people who specialize and then trade by watching different things on different TV channels.

And then it certainly applies in the labor market. It's much better for me to concentrate on economics and for an engineer to concentrate on creating some product than for us to both try to do a little bit of that thing. That's one idea I would start with.

What's the next big idea? I think let's start with that one and think about whether there's anything else-

Guy Kawasaki:

I told you you're going to do 95 percent of the talking. I wasn't kidding.

Paul Oyer:

I guess so. Four or five economics ideas is tough.

I think another really great idea that's come out of economics in the last forty or fifty years is the importance of information in markets, and understanding what people have what information and how that affects both the prices and behavior of people, and how you can hide your actions or hide your information in a way that has tremendously important effects.

And that affects the economics of education. For example, applying to different types of schools. It affects the job market because the information you have about what would make you a good employee is something that firms want.

And then trying to figure out how to determine whether I'm doing a good job or not is another piece of information asymmetry.

And any sort of contractual negotiations, these sorts of things come up.

So information economics has really dramatically changed over the last thirty to fifty years and it just affects everything in the economy on a daily basis.

Guy Kawasaki:

Okay. I want to return a little to your online dating. First, I've never heard online dating, or any service described as a thick economy.

Can you explain how online dating is a thick economy or a thin economy depending on the service you're using?

Paul Oyer:

Sure. Thickness in markets is a really good thing. In the old days before there was online dating, if you were looking for a mate, you were in what we would call a very thin market because you would only have the people you knew and the contacts they had and so forth.

So if you wanted to go find a mate, you were choosing from a relatively small set of people. And the odds that you would find somebody who was appropriate and that person would also find you appropriate, they're just small. On a one-off basis, finding the right person's really hard.

What online dating did is it just changed the market in a really important way. So instead of just operating in the ten people you knew, you're now operating in the hundreds of thousands of people who go on Tinder or whatever the current hot app is.

And that is really important in a market like dating, where heterogeneity is critical.

The thing about dating markets and the job market, this is, remember I'm a labor economist, I wrote that book because it's applications of labor economics more or less, having many more firms to choose from or many more mates to choose from makes the possibility of finding a great match much better.

So if you think about our great grandparents, who mostly married other people in the smaller villages they came from, those relationships often worked out very well. But in a more modern economy where there's a lot more going on, it's nice to have a broader set of choice and to be able to hone in on people who are really good matches for you in terms of anything from their interests to their attitudes towards life, towards the things they love and so forth.

So a thick market is just when there's more choice for all participants in the market, that leads to better matches and better outcomes.

Guy Kawasaki:

But didn't you meet your significant other on a thin dating site?

Paul Oyer:

No. I would argue not at all. We met on JDate, which is thinner than the whole market, but it's still very big. JDate is a site for Jewish people.

Now I was only on that site because I was looking at markets that were thick for educated and highly skilled people, and JDate and some of the other sites worked very well for that. And it was a thick market. There are a lot of people on JDate.

Now, sure, it is narrowing things down because you're only looking at Jewish people. I was on other sites. I didn't actually care whether my mate was Jewish or not. I am Jewish and that was great, but it wasn't a particularly important trait for me. But having said that, it is true that thinning the market down by focusing on Jewish people does make the market somewhat thinner.

Another dating site that hasn't done as well that existed back in the time when I was on the dating market, it probably doesn't exist anymore, is a dating site for people interested in tennis.

I'm a big tennis player, but that market of people who care about tennis enough to let it determine who they're going to spend their life with, that is a very thin market. And so then once you get down to people that focused, then you're talking about a much smaller and thinner market.

And I don't think that type of site has been as successful. Whereas sites like JDate, the Mormon dating sites, are very successful. The sites that focus on older people meeting each other are very successful.

So those markets do make the market somewhat smaller and thinner, but in a way that there's still enough critical mass and enough focus on something that's so important that the market works really well.

Guy Kawasaki:

And if a market is not thick enough, would a person's listing prolong the adverse selection stigma?

Paul Oyer:

It's a good question. The idea of adverse selection is that sometimes the fact that you're interested in doing something reveals that you're not very attractive.

Again, this comes back to your earlier question about is there one economics or is it many? And adverse selection applies everywhere. It applies to markets for dating sites for employees.

George Akerlof won the Nobel Prize for his paper in adverse selection, which is focused on the used car market. The idea behind the example he gave was, if I have a used car for sale, and I can't tell the good ones from the bad ones, the people who have the good cars for sale are going to take their cars off the market because they can't get enough value for it, and the only ones available in the market are going to be the lemons.

So if you apply that to the dating world, in the very early days of online dating, you only had people who couldn't find a date through the conventional methods would go onto online dating sites. There was a stigma, and it was the site of last resort.

And so then you had the real adverse selection problem in the early days. Luckily over a period of time, which played out before I was on the dating market, so I didn't have to worry about this as much, over time it became apparent that while dating the old fashioned way through friends and family has a certain traditional value to it, the thick markets that were potentially out there once that stigma was driven away was just a way more efficient way to find mates.

So going out in an anonymous dating site is so great because you don't have to worry about what people think of you. They don't know you. If it doesn't work out, you just move on with your life. Whereas if you get introduced to somebody by your friends and it doesn't work out, then it's weird.

So eventually the dating sites worked out very well, but you're absolutely right. Initially there's this, “only the losers are on dating sites.” And that led to an adverse selection problem where the other people wouldn't go on those sites because they thought they wouldn't meet anybody they wanted to meet.

Guy Kawasaki:

Let's suppose that you've had a decades long successful career. You worked at Apple and Google and Canva and you've written fifteen books and you have a successful podcast.

Should you not be on LinkedIn because people would say, "Why would he be on LinkedIn? Is he looking for a job?" Is there an adverse effect when you're... I mean, I don't know if Elon Musk has a LinkedIn profile or Bill Gates or Tim Cook.

Paul Oyer:

That's a great question. At what point do you want to take yourself off LinkedIn because you're such a guru or such an amazing person? I'm trying to think of a different example where you would want to take yourself off at a certain point.

LinkedIn is now so pervasive in the world that I don't think there is any downside to being on LinkedIn. True partners in venture capital firms that are very successful are on LinkedIn for the most part. I don't know if all of them are. I think LinkedIn is enough value that there's no real stigma to it.

I think you do have a good point. I'm trying to think of what mediums you would want to pull yourself from at a certain point. There must be some.

Guy Kawasaki:

Going back to dating. If your profile has been up there for two years, that's not a good sign, is it?

Paul Oyer:

No. I think that's a great example of an adverse selection problem. If somebody's dating profile has been up there for two years, that's definitely not a good sign. Of course, the only way somebody's dating profile is up there for two years is if you've been looking for two years.

Guy Kawasaki:

Which makes you a loser too.

Paul Oyer:

Exactly.

Guy Kawasaki:

I'll keep that in mind if I ever get divorced.

In your dating book, I was just amazed that you basically just came out and said that if you're a woman and you're not attractive and you're a man who doesn't make a lot of money, you're going to face some significant challenges on dating sites.

Paul Oyer:

Yeah. That comes back to our causal inference conversation. Those are not great conclusions. They don't feel good to either of us, but they're empirical facts and the evidence on them is clear and causal. Maybe society has changed in the eight or ten years since the studies I cite were done.

Men's preferences for women is, and we're talking about heterosexual relationships here, so there isn't as much good data on same-sex relationships where the dynamics might be very different, but within heterosexual relationships, the preferences of men are pretty clear that looks are very important. And by the same token, women are attracted to money.

Now, those aren't the only factors. Let's be also clear. Those factors are important and in a way that's asymmetric for men versus women, but they're not the only factors. Women care about the looks of men. Men care about how much money women make.

And then there's just all sorts of other factors that drive both. For example, how interesting a person is, how funny a person is; those things really matter in relationships. Those are harder to tell the effect of them on an online dating site because I can't tell if you're funny or not... well, I can get a little sense for that.

But in terms of the initial attractors, looks in the case of men picking women, and money in the case of women picking men, they're out-sized influences.

That's just an empirical fact. You can draw your own value judgment, but that is what it is.

Guy Kawasaki:

I just interviewed a woman who wrote a great book and has one of the best titles. Although your books have pretty good titles too, don't get me wrong.

But her book title was Ejaculate Responsibly. She makes the case that birth control is totally one sided and it's all about the man and et cetera, et cetera.

The reason why I asked this is that maybe on dating sites, if you're a man and you're not that attractive and not that rich, you should at least volunteer that you have had a vasectomy and then it would just show that you're so much more responsible. But I digress.

Paul Oyer:

Of course, an economist would say that would be cheap talk anyway. You'd have to prove you've had a vasectomy. Anybody can say they've had one.

Guy Kawasaki:

Some man would say, "Let me prove it to you." But anyway, okay.

Paul Oyer:

Yeah, we're definitely digressing. We are definitely digressing now.

Guy Kawasaki:

We're now gone from Stanford level to Cal level or maybe even USC level.

If we could talk about crypto, blockchain and NFTs from an economist perspective. I think a lot of people, when they get into this topic, they glum all three together. Crypto, blockchain, NFTs, is all one thing. I think that is a massive disservice and inaccuracy.

I would like your take on crypto as an asset class, blockchain as an underlying technology, and NFTs as a methodology to tokenize maybe sports tickets or prove the legacy of an art piece or something. What's an economist's take on crypto, blockchain and NFTs?

Paul Oyer:

That's a great question and I think the simple answer is it's evolving and there's a lot of skepticism among economists, but also openness. Some of the initial enthusiasm has waned about having a neutral currency because we're not seeing enough use cases for any of the three.

NFTs is slightly different.

But blockchain and crypto, it's really hard to see where there's some use case for them in terms of their adding to the efficiency of the economy. What are they doing that we couldn't do before?

And there are examples given in blockchain. The best one I've heard is this business where... what is it? You get tokens when you sell your own Wi-Fi capacity to the internet of things thing as they drive by.

That seems like an actual value added of keeping track and adding some currency to allow something like unutilized Wi-Fi capacity to get traded more efficiently. Although I've seen arguments why even that particular example isn't as good as we might have thought.

But rather than get into the specifics, I'll just say there are not a lot of great examples of thanks to blockchain and thanks to crypto, we can do things we couldn't do before better, and I think with the exception of things we don't want people to do. So holding a computer ransom, crypto's very helpful for that. But I don't think we necessarily want that.

I think most economists don't know this space as well, and I certainly don't, in terms of what's technically feasible. I think we see a lot of investors pouring money into the blockchain and usually investors know what they're doing. But having said that, it's hard to see the use cases.

Guy Kawasaki:

How about this, since you wrote a book about sports and your book includes a chapter on scalping. So how about if tickets become NFTs? So if the forty-niners sell a ticket, they know exactly who it's going to. The buyer also knows it's a legitimate ticket. And then if the buyer scalps it, the forty-niners gets a second tranche of revenue because they're controlling the trueness of the ticket. Would that help?

Paul Oyer:

I think it would potentially help the 49ers. It's not going to necessarily get the ticket used more efficiently, meaning get it to the person who's going to get the most value out of it. We already have resale markets for that, and I don't know that we need an NFT or a blockchain to make that any better. It might help the forty-niners get the money a little bit better.

So I think that's a reasonable example to think about.

I actually like to see tickets just get sold and then resold as people like to, because I like to just see markets be relatively fluid and let things move around.

But if an NFT could be done in a way that kept the market quite fluid and allowed the forty-niners to extract the value that they're providing, then I could see that.

I'm just not sure that the ticket market as it works is so problematic. You mentioned counterfeit tickets, and that's not really that big of a problem.

Guy Kawasaki:

Okay. Let's pretend for a second that the CEO of eHarmony or Tinder or JDate reads your book and says, "Okay, tell me what should I do differently? How can I differentiate my dating site from the other fifty of them?"

Paul Oyer:

I have a couple of ideas on that. One that doesn't apply to the big ones but might apply to a startup is, I think, trying to be exclusive and charge a lot is a reasonable business model.

On the one hand, you want a thick market, but you could imagine having a small but pretty thick market of people who are really very successful people. So they want to stay within their particular group when looking for new mates and they'd be willing to pay a fair amount.

So rather than make the sites as cheap as possible, which has been an emphasis over time, making a smaller market and trying to make a lot of money off of those people. Now that's not a great idea for society. That just seems like a good business model.

From a societal point of view, where I think there's a lot of value, and from the individual firm's point of view, and there's a tradeoff here on the privacy side, but I think doing a better job of enabling people to verify what they say about themselves.

So making people more assured that what they're reading about people on dating sites is accurate, it would be really helpful.

So finding ways to verify age, height, income, other things that people tend to lie about, I think would make people, especially women, feel more comfortable being on site.

Now that comes, like I said, with a tradeoff because there's privacy issues with that.

Guy Kawasaki:

Haven't you just described LinkedIn for dating, because I think on LinkedIn you're more likely to be who you really are than on Facebook, for example? Not that I'm advocating that LinkedIn get into dating, but that's the point, right? There's a value to knowing who you're really dealing with.

Paul Oyer:

But even on LinkedIn, you can say anything you want. The only thing that makes LinkedIn work well is you have people on it who give you referrals and they have the endorsements and things which you wouldn't want to do in a dating context.

You don't want your exes being able to rate you. The customer reviews like on Uber, it doesn't work as well on a dating site.

Guy Kawasaki:

So this is Yelp meets Glassdoor, meets LinkedIn, meets Tinder?

Paul Oyer:

Yeah. It's not going to work on Tinder.

Guy Kawasaki:

I want to shift to labor economics now. So let me posit that Theranos was a spectacular failure.

Paul Oyer:

I don't think you're going to get much argument on that one.

Guy Kawasaki:

Okay. Let's also posit that Google is doing some downsizing now, but they're keeping most of their employees.

So would you say that it is better to be laid off by Theranos as it implodes than being downsized by Google as it continues to stay in business?

Paul Oyer:

Yeah, that's a really great question. Let's go back to your very first question to frame this, not to answer it. And that is, I can tell economic stories that would predict both of those outcomes.

And boy, I would love to do a controlled study to look at that. Wouldn't it be great to know... because there's black marks from both of those things; from being laid off by Google or losing your job at Theranos when it implodes.

So when you lose your job at Theranos because it implodes, what's the black mark on you? If you look back at someone who used to work at Theranos, you can't help but wonder, "Well, what was wrong with that person? How did they not see this problem? How are they going along?" And your inference thinking about information economics, what information are you going to infer about the person who was a Theranos?

One is maybe they were stupid, and they were just naive about what was happening. The other is they might have been incredibly crooked and dishonest.

But there's a third possibility, which is they really believed in the mission of what they were trying to do and they were working hard at it and they were making real progress, because I think there was some progress being made at Theranos.

So on the one hand, there were probably a lot of people there who were doing the right thing and were in the wrong place at the wrong time. So the question is, which of those possibilities dominates as you look after the fact?

Now at Google, if I get laid off from Google right now, what do I infer from that? On the one hand, I might infer, well, if the person worked at Google a long time, they were at a successful company and they were part of it, and that's a great thing.

On the other hand, if Google is doing a downsizing, and they lay off a bunch of people, you can't help but wonder, these people that they're laying off, what did they do wrong? Because they're making decisions about who to lay off. They're not randomly picking people to lay off.

So I think you've just described a wonderful empirical economic labor market study that somebody could do if they had the data, which is really hard to get in this particular case.

There's a classic paper written in labor economics, oh it's got to be twenty-five years old now that was called Layoffs or Lemons. And it was along the lines of what you're suggesting. What they said is, look, people get laid off, there's an inference about them that has a negative connotation for future jobs.

And they compared people who were laid off to firms that kept going versus people who left their firm because it had shut down. And they found that in fact, people that left their firms because it was shut down had less of a problem getting re-employed than people who were let go as part of a downsizing.

Guy Kawasaki:

So how about this? So if you are sensing that you're going to be laid off, that you're not going to be retained, would it be better if you quit?

You had a different story that I decided that whatever Google was now doing harm, that they were creating technology for armed forces, I don't know, whatever bugs you, and so you quit before you're laid off. But then you say to yourself, but then I don't get the package.

Paul Oyer:

Exactly. No. You just outlined the tradeoff strategically; which thing would be better? I would guess that the package is worth it in most cases, because you also don't know for sure if you're going to be one of the ones laid off.

And if you have a track record of success at Google for a while, then hopefully you can ride it out. But the example you gave is a good one of potential adverse selection and people have to be strategic about avoiding that.

Guy Kawasaki:

Let's look at the opposite side of adverse selection. So if I read the headlines and I see people at various Amazon warehouses and Starbucks are trying to unionize, do I conclude that the company sucks as far as employee treatment?

Paul Oyer:

I'm trying to think about the right way to think about that. You definitely have a group of people who feel that they're being treated unfairly. So yeah, I think that's problematic. If I'm thinking about joining a company and I see that the employees there are unionizing, should I infer bad things about that company?

I don't think it's a great sign. But by the same token, I think it's a good sign that the employees care enough to try to do that and that they may be making some inroads. There are probably many other companies where employees would like to unionize but don't bother trying because they're afraid of losing their job or something like that.

So the exact inference you can draw from this is you definitely are right; there's a negative side to it, but potentially a positive side as well.

Guy Kawasaki:

Do you believe that talent will flow out of states with restrictive reproductive rights that women will not want to work in that state?

Paul Oyer:

It's a great empirical question. We just don't know. There's so many things caught up in where people live. We do know people flow out of states with high tax rates, everything else equal. So I stay in California and most people who live in California stay there.

But on the margin, a lot of people, especially those who make a lot of money and can work from anywhere, have moved from California to other states. So we know people base their location decisions on factors that affect their happiness, in this case, the case I just gave you, is taxes.

Now what about reproductive rights? I think that's a great question, Guy. I'm very curious to see the answer because being a woman in Texas is different now than it was a few months ago.

Now what's unclear to me, I'm no lawyer or expert on reproductive rights laws, is how easy it's going to be for someone who lives in Texas or some other state that restricts abortion, how hard it's going to be for people who have the means to leave the state to get an abortion to do so.

As long as I can just leave the state, get an abortion and come back, then where I live isn't as problematic. But that's assuming you're a person of means. The problem is there are probably a lot of women who would love to move out of states where reproductive rights are being limited because if they were in a position where they needed abortion, they don't have the ability to just get up and travel and go back and forth.

So the thing about the types of restrictions that are now being imposed in some of these states are they hit very unfairly on people without means relative to those with means. But those people can't necessarily get up and leave the state either. If you look at migration rates between states, they're much higher for higher income people than lower-income people.

You've asked a great question that we're all watching, and those of us who are very unhappy with the way reproductive rights laws are going in this country are curious about and really worried about.

But it's a little too early to see which way the data will point and how dramatic that will be in terms of people moving from one labor market to another.

Guy Kawasaki:

Okay, enough about sex. So now let's talk about the gig economy.

The fundamental question is why are gig workers working gig jobs?

Paul Oyer:

Many of them are doing it because they want to. The gig economy's become so prominent lately because of the rise of Uber and Instacart and things like that.

But we've had a gig economy for as long as we've had an economy. We have contract workers. We've had independent contractors for many, many years now doing all sorts of things, freelancers, whatever term you want to use.

And it's only risen recently because it's gotten easier to match people to short term gigs. Technology's enabled the gig economy to grow quite a bit, but it's still not the norm. Let's keep in mind that the gig economy is still a small part of the overall labor market.

Most of the people who work in the gig economy do it because they want the extra income and/or the flexibility of working in the gig economy.

Now there is a set of people who work in the gig economy because they can't find a "real job" or a historical W-Two job. And often that's a transitory thing.

So people work as an Uber driver while looking for a traditional job. So I think that's mostly what it is. It hasn't grown as quickly as people might have thought. I think the popular press would give you an impression the gig economy is taking over, or at least that was the impression a few years ago.

Maybe that's dried up. Maybe that's slowed down a little bit. But it's growing. It has grown, but it's not taking over.

Guy Kawasaki:

Your book showed me a whole different side to the gig economy, and I refer specifically, believe it or not, to the windshield example.

I thought that maybe gig workers that couldn't hold a full-time job or a regular job or they weren't good enough to get employed and all that and with a permanent job, but you make the case that with this windshield installer example, where they went from a per hour flat rate to a fee per installation, that it increases quality of people because only the people who can do good work fast can make a lot of money.

So the gig worker may in fact be the best worker, not the mediocre or worse worker. Now, I don't know what to make of that. How do I wrap my mind on a gig worker?

Paul Oyer:

I think you make a good point, Guy. The entrepreneurs are the most motivated people in the world. They have everything to gain from what they do. Self-employed people, entrepreneurs, whatever.

And gig workers are entrepreneurs and self-employed and that gives them a lot of motivation to get up and go do things. So you're right, if you're an Uber driver, you can't just turn off the app and keep getting paid by the hour. You've got to keep doing the work.

There may be a few people in the gig economy who, as you put it, can't have a real job but who are incredibly motivated. That is, they may not be able to hold down a regular job because I don't know, maybe there's certain social aspects of traditional work that they're not as good at, but they can do certain tasks so well that they're going to be very motivated in a gig work to do a good job.

It could also be sometimes certain gig jobs, I don't know which ones, I'm not making any statement about any particular company here, but there might be certain restrictions around drug testing that make it hard for some people to get traditional jobs, but they can get gig jobs.

But that doesn't mean they're not incredibly motivated while they're doing their job.

Yeah, I don't think there's any reason to think of gig workers as being unmotivated. They may be unmotivated to hold down a traditional job either because they like the flexibility or they don't like having a boss or something like that. But a lot of gig workers are real hard workers.

Guy Kawasaki:

What if, Paul, you were trying to create your website, so you needed a Python programmer or HTML coder or something, would you put more faith in someone who's working for a web design agency, or it's a difficult example now, but the proverbial Ukraine programmer working out of his house, who has done this amazing HTML work? Who do you put your faith in?

Paul Oyer:

I think I can make a case for either one under certain circumstances.

So the person who just does it in my company for a living, they may not have the short term motivation to really get on and do a cracker jack job right away. Even jobs where you don't get paid by the piece, there's a lot of motivation to do a good job because you want to have a good reputation, you want to get a good raise, a good bonus and so forth.

So I think that can work very well. But by the same token, people who gig work online, they have a lot of motivation to do a good job, get a good rating, get rehired.

So I don't know that I would pick one versus the other based just strictly on motivation. I might think more about the experience of who's going to be in a better position to do that particular task.

Guy Kawasaki:

I am just going to use my limited time with a labor economist as much as I can because this is the first for me, all right? What would really be the effect of raising the minimum wage?

Paul Oyer:

Yeah, that's a great question. There are so many labor economists who studied this so much more than I have, Guy. I'll give you my synopsis because I've read this literature quite a bit, but I've never contributed to it. It's really interesting because there are many circumstances in which raising the minimum wage will just transfer money from customers and firms to those workers.

That is, it won't really affect the demand for labor and they'll get paid more. And that's probably a good thing because the people at the low end of the spectrum need the money more than the firms or the customers of those firms who have to pay higher prices.

So there's a lot of value to raising the minimum wage because it's a good way to fight poverty and do good, and in many places in small doses it won't have much negative effect.

But having said that, take it to the extreme. If we raise the minimum wage to 100 dollars an hour, you'd see the demand for labor in certain sectors just fall off a cliff. So we know that if you raise the minimum wage enough, you're definitely going to raise the wage of a lot of workers and you're going to lower the wage of a number of other workers when they lose their jobs.

And so getting that balance just right is really a hard one for policymakers, and not one they're always that well equipped to fight.

So the simple answer to your question is at a certain point, minimum wages really do bite. They really have big negative effects on demand for labor.

And then in a lot of other settings, smallish, medium, minimum wage changes are pretty clearly a good thing because they help with alleviating poverty. And even though they're costly to firms and some customers, they're not bankrupting them.

Guy Kawasaki:

Wait, why does raising the minimum wage have that negative effect of fewer jobs?

Paul Oyer:

Well, think about a fast-food place. That's the canonical minimum wage job. If I raise the minimum wage by ten dollars an hour and now it's twenty five dollars an hour, the fast-food places are going to do two things. One is some of them are just going to either close or lower their hours because now the costs of doing business are much higher and they have to rethink whether it's even worth being in business. The other thing they're going to do in the medium term, you can't do this tomorrow, is automate.

So if I raised the minimum wage, in the old days I was choosing a fifteen dollars an hour worker and making a lot of investments in automation so as to get rid of the cashiers. Once I raised the minimum wage to say twenty-five dollars an hour, that investment in technology begins to look a lot better.

And then if I had ten people working in the store before with the investment in technology, I might be able to go down to five people. And so then I've lost five jobs.

Guy Kawasaki:

If you were advising or running Tinder and eHarmony, you did a tour of duty as an Uber driver, so what would you do differently if you were the CEO of Uber or Lyft or TaskRabbit? Pick one.

Paul Oyer:

Yeah, so this was a number of years ago. I was writing a paper using Uber's data about Uber drivers. The thing about that project was I wish I could do this for every project.

I've written papers about software engineers, about lawyers, about investment bankers, and boy, I wish I could go spend a few days doing those jobs because I would've had a lot of institutional knowledge that would've helped write those papers. The beauty of writing a paper about Uber drivers is I could go out and try that job.

So I drove my car around for Uber for a little while. And boy, that was super interesting. It's a hard way to make a living.

Now the thing that you have to appreciate is being an Uber driver, I'm very lucky I don't have to make a living that way because it's a hard way to make a living and it's not a huge amount of money for sure, but you do make close to the same amount of money after expenses that you would make doing certain other low-wage jobs like fast food or other sorts of lower skill jobs like that.

And there's a lot of people for whom that job is really good and a lot of people for whom more social jobs in a restaurant or something might be a better fit and with a more regular schedule.

I think the only advice I would give to Uber and Lyft and so forth, they've become pretty good at figuring out their business model over the years, not great and still don't make a ton of money, but I think the main thing is just being really as honest as possible with drivers and potential drivers about what the job is because a lot of drivers try it and it's not a very good fit.

And just trying to get through that, making sure people understand what it really involves as quickly as possible, I think is important. Because it's a good job for some people relative to their other options and it's not a good job for others, and figuring that out as quickly as possible is valuable for both the employees and for Uber.

Guy Kawasaki:

Okay. Now the last topic; sports. Let's say that your brother or sister reaches out to you about your niece or nephew. Let's further posit that you like your brother or sister and you love your niece or nephew, okay? We got to put a lot of qualification-

Paul Oyer:

I started under that assumption, but I'm glad you've made it explicit.

Guy Kawasaki:

That's like saying, “Would you give that to your wife?”

Well, depends on your relationship. But anyway.

So your brother or sister is reaching out to you about your niece or nephew and they ask, "Should we push Johnny or Susie into sports or extracurricular activities because it will help them get into college?" And you, as the economist at Stanford, says what?

Paul Oyer:

Great question, and one that comes back to your original point about causal inference. The science on this isn't as clear as we'd like because there's not a lot of good experimentation on this.

So you can't randomly assign kids to be in youth soccer or not, or to be on a travel baseball team, or-

Guy Kawasaki:

Or to play video games all day.

Paul Oyer:

Or to play video games, or to play violin ten hours a day or something like that. Unfortunately, the random assignment or the other ways of naturally sorting people isn't that great. The literature on this isn't as clear as we'd like it to be.

But my conclusion, and I think most economist's conclusion based on the work that's been done is there's not a lot of evidence that athletic or other extracurricular pursuits have a big payoff later on. Sure, you want to get into college, but there's no reason to think you would want to do extracurricular activities beyond those that were fun for you anyway.

The economist conclusion on youth is... economics, don't forget, is not the study of money, it's the study of scarce resources. And the scarcest resource we have is our youth. I think the advice I would give to my sister or whoever is, don't waste your youth.

If you are really into baseball or violin or whatever, go for it and enjoy that. But don't do it because it's going to pay off later in life. There's no real reason to think it will.

Guy Kawasaki:

I think you make the clearer point that that's true about sports or extracurricular activities, but there is no debate that getting a good education is meaningful.

Paul Oyer:

That's one where causal inference studies are really aligned. More education, everything else equal, is better. Now there can be exceptions to that. Steve Jobs, we talked about before, is an exception. But there's just no question that getting education is a good thing.

So that's the argument for doing extracurricular activities is it helps you get an education, but just do the extracurricular activities you enjoy and would do anyway even if you weren't trying to get into college. Those are probably enough to get you the benefits anyway that will get you the education that you need.

Guy Kawasaki:

So the bottom line is get an education.

Paul Oyer:

Stay in school. Get an education. I realize that as a professor, that's an incredibly self-serving statement, but I can say that with the honesty that all the science is very clear on this.

Guy Kawasaki:

I think I read in your book that it shows a 50 percent difference in compensation.

Paul Oyer:

If you'd look at, say, college graduates versus high school graduates, at least 50 percent.

A rough number is every year of education is going to increase your income 8 percent for the rest of your life. If you get one more year of education, your income later in life will be 8 percent higher.

Guy Kawasaki:

And just to pound the dead horse; it's not because the people who went to college are naturally harder workers or smarter or something. This is a causal relationship.

Paul Oyer:

Yep, absolutely.

Guy Kawasaki:

Two identical people; same attitude, same energy, same grit, same everything. One goes to college, one goes to high school, the college graduate will make more money.

Paul Oyer:

Of course, I have to put the caveat that like any one person, it won't necessarily work that way. But on average, the two people you just described who are literally identical, we would expect the one who went to college to make 50 percent more than the one who stopped their education after high school. Absolutely.

Guy Kawasaki:

Wow. Okay. I've had you for one hour, twelve minutes and twenty-eight seconds. I don't know how I could pump you for any more knowledge and information about economics than I could in the last one hour, twelve minutes and thirty-nine seconds. You did 95 percent of the talking and that's the way it should be.

Paul Oyer:

Thanks, Guy. I really appreciate having the chance to do so much talking. Who doesn't like to talk a lot, right?

Guy Kawasaki:

Far be it for me to tell a professor of economics at Stanford's Graduate School of Business that talk is cheap. But I digress. I hope you enjoyed this episode with Paul Oyer. Practical and tactical personal economics about quitting, online dating, sports, minimum wage, lots of stuff that many of you can use in your daily lives.

And now it's time to express my gratitude for this episode.

First is Jennifer Aaker. She is also a professor at Stanford's Graduate School of Business. She recommended Paul and then introduced me to him. This episode would not have happened without her help.

And then there's the Remarkable team, Peg Fitzpatrick, Jeff Sieh, Shannon Hernandez, the drop-in queen of Santa Cruz, Madisun Nuismer, and Luis Mad Dog Magana and Alexis, the college applicant, Nishimura.

Until next time, Mahalo and Aloha.

Sign up to receive email updates

Enter your name and email address below and I'll send you periodic updates about the podcast.

Leave a Reply