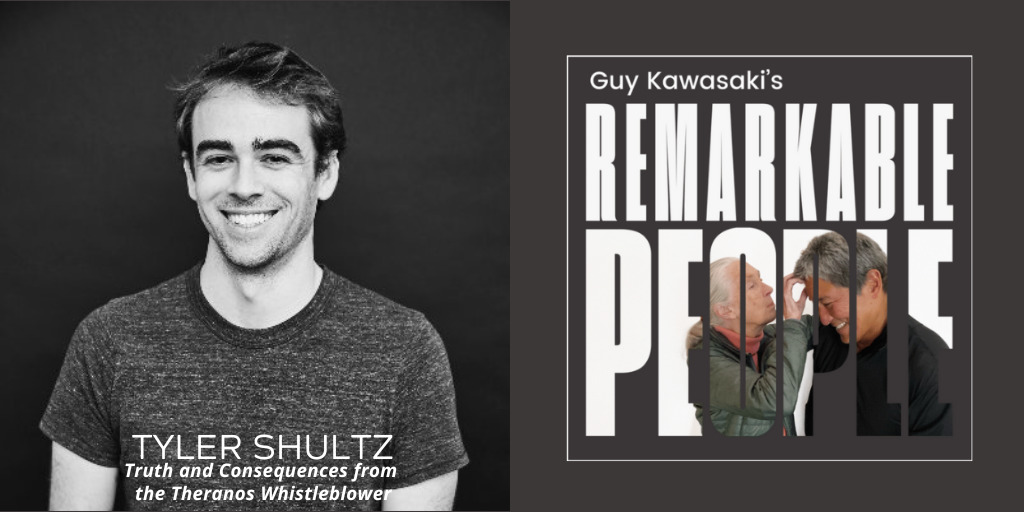

I’m Guy Kawasaki, and this is Remarkable People. We’re on a mission to make you remarkable. Helping me in this episode is Tyler Shultz.

Saying that Tyler is remarkably brave is an understatement. He was the whistleblower on the Theranos debacle that led to the conviction of Elizabeth Holmes.

Someone is truly remarkable when they aren’t afraid to speak up, especially when it means they will pay a big price. In this case, a big price means upending your relationship with your grandfather, incurring $500,000 in legal fees, occupying approximately ten years of your life, and being harassed by the Theranos team.

His grandfather, by the way, was George Shultz. George was a former Secretary of State, Secretary of Labor, Secretary of the Treasury, and director of the Office of Management and Budget. The interview starts with the night that George asked Tyler if he had talked to the Wall Street Journal. Specifically, John Carreyrou, the author of Bad Blood: Secrets and Lies in a Silicon Valley Startup.

If you search for Tyler’s name in the book, it appears approximately 200 times.

Tyler studied biology at Stanford University, was a summer intern at Theranos his junior year, and later became a full-time employee. He worked as a Research Engineer there for eight months before revealing the scam.

Today, Tyler is the co-Founder of The Healthyr Co., which allows consumers to take charge of their health through early identification of issues. It provides valuable health insight and actionable interventions to its customers.

He has received the James Madison Freedom of Information Award along with being placed on the Forbes 30 Under 30 Healthcare list.

Please enjoy this timely episode with Tyler Shultz:

If you enjoyed this episode of the Remarkable People podcast, please leave a rating, write a review, and subscribe. Thank you!

Transcript of Guy Kawasaki’s Remarkable People podcast with Tyler Shultz:

Guy Kawasaki:

I'm Guy Kawasaki, and this is Remarkable People. We're on a mission to make you remarkable. Helping me in this episode is Tyler Shultz.

Saying that Tyler is remarkably brave is an understatement. He was the whistleblower in the Theranos debacle that led to the conviction of Elizabeth Holmes.

Someone is truly remarkable when they aren't afraid to speak up, especially when it means they will pay a big price.

In this case, big price means upending your relationship with your grandfather, incurring $500,000 in legal fees, occupying approximately ten years of your life, and being harassed by the Theranos team.

His grandfather, by the way, was George Shultz. George was a former Secretary of State, Secretary of Labor, Secretary of the Treasury, and Director of the Office of Management and Budget.

This interview starts with the night that George asked Tyler if he had talked to the Wall Street Journal, specifically John Carreyrou, the author of Bad Blood: Secrets and Lies in a Silicon Valley Startup.

If you search for Tyler's name in the book, it appears approximately 200 times.

Tyler studied biology at Stanford University and was a summer intern at Theranos after his junior year.

He later became a full-time employee. He worked as a research engineer for eight months before revealing the scam.

Today Tyler is the co-founder of The Healthyr Company. This company enables consumers to take charge of their health through early identification of issues. It provides valuable health insights and actionable interventions.

Tyler received the James Madison Freedom of Information Award, along with being placed on the Forbes Thirty under Thirty Healthcare list.

I'm Guy Kawasaki, this is Remarkable People, and now prepare to hear a remarkable, arguably depressing story, about Silicon Valley startups.

Here is the remarkable Tyler Shultz.

If you had told your grandfather that you had talked to the Wall Street Journal when he first asked you, how would things have changed?

Tyler Schultz:

Yeah, that is a really interesting thought experiment, and I actually was debating whether I should tell him the truth from the get go.

I discussed this with one of my housemates I was living with, I basically said, "I'm going to go over to my grandfather's house," and I was panicking, and he said, "What are you going to tell him?" And I said, "I'm going to tell him the truth." Because I've always told the truth, and I felt like if I continued to tell the truth that things would work out for me.

And he just said, "Dude, you should definitely lie." And his reasoning was that I really didn't know it was at stake, and I should really go over and I should collect as much information as I could before I decided to tell the truth, and I could decide to tell the truth at any point if I wanted to, but first I should just gather information and make sure that was the right decision.

And I think, looking back, that was really good advice, and had I gone over to my grandfather's house and told him out of the gates, "Yes, I've been speaking to a Wall Street Journal reporter," there were Theranos lawyers in the room right up the stairs and they would've come down and they were ruthless lawyers, and they would've definitely been able to pressure me into signing their affidavits, and I would've been backed into a corner that I wouldn't have been able to get out of.

So in this situation I think it was the right decision to lie, I told them that I had not spoken to the Wall Street Journal when I had, and really that bought me some time to get my own lawyers.

Guy Kawasaki:

When you say that would've backed you into a corner, but you were still telling the truth about what was going at Theranos, so it's not like you were covering something up, so what corner would they have you in? Your NDA?

Tyler Schultz:

Yeah, they would've said that I violated my NDA, that I was giving away trade secrets. They believed that those trade secrets were worth literally billions of dollars.

I think it just would've been harder for me to get out of that specific encounter with the lawyers in my grandfather's living room, and at that time I had no legal counsel, and I had no idea what I was doing, and so I think it was just a lot easier to just say, "No, I haven't spoken to them, I don't know why you think I've spoken to the Wall Street Journal, but I haven't."

Yeah, so I think things really worked out. I got a little lucky, not going to lie.

Guy Kawasaki:

And what did her team do to you? What did they try to do to you?

Tyler Schultz:

They tried to do a number of things. So one, they wanted me to feel like I was the crazy one.

They said that 80 percent of what the Wall Street Journal had only came from me and me alone, that there were no other sources. That once the Wall Street Journal published their article that my career would be over, that I would never get a job ever again.

They tried to run me out of money. We were in an intense legal battle, I ended up spending around $500,000 in legal fees. Their goal was just to completely deplete my resources and my parents' resources. They had private investigators following me, and my family, and my legal team.

And at one point I realized that the point of the private investigators wasn't to actually see where I was going, who I was having lunch with, any of that, the goal of the private investigators was to scare me. They didn't really try to hide it.

I met with the Wall Street Journal reporter once, and the Theranos lawyers let me know in the next two days that they were aware that I was meeting with the Wall Street Journal reporter again, and they weren't trying to hide the fact that they were following me.

And then actually in the trial, being able to actually see the checks written to the private investigators made it even more real. It was definitely a scary, dark time.

Guy Kawasaki:

And your father, at Elizabeth Holmes' sentencing, said that you were sleeping with a knife, you were afraid for your wellbeing?

Tyler Schultz:

Yeah, I was actually.

So there was one specific instance where my parents met with a lawyer. I had my own lawyers, and we decided it made sense for my parents to get lawyers as well. And so they met with their lawyer for the first time, they exchanged notes and documents, and things like that.

And then after the meeting their lawyer went to a wedding, and during the wedding someone broke into her car and stole her briefcase that had all of those notes and documents.

And it's totally possible that's a complete coincidence, it's very likely that's a complete coincidence even. But when you're being followed, and when you know how scary these people are, how powerful these people are, how much money these people have, what's at stake for them, it seriously makes you question where the line is.

And I didn't know where the line was for them, and I thought it's totally possible that they'll try to just knock me off. And there were times when in the middle of the night I would hear rusting outside my window and my heart rate would just skyrocket and I thought, I would literally think, tonight's the night that Sunny whacks me.

So it didn't provide a whole lot of comfort, but I did sleep with a knife just on the other side of, right under my mattress. I also carried pepper spray with me for a long time.

Guy Kawasaki:

What was the rationale, they're going to scare you into recanting, to lying for their side? Give them more crap about the Wall Street Journal they can use against the journal? What was the point of trying to intimidate you?

Tyler Schultz:

Yeah, so they weren't necessarily trying to convince me that the Theranos technology really was everything that they said it was, they were just trying to convince me to back out of being a source for the Wall Street Journal.

That's all they wanted out of me, they were like, "We're going to bully this kid, we're going to scare this kid until he just shuts up," and I wouldn't do it.

Guy Kawasaki:

Now, after her sentencing, a week from Sunny's sentencing, do you feel safe? Is this part of the nightmare?

Tyler Schultz:

Yeah, definitely. I have not feared for my safety for a long time.

Guy Kawasaki:

Can you tell us generally what happens after you blow the whistle in something like this, what happens to the whistleblower?

Tyler Schultz:

In my experience when you blow the whistle on something like this, you're bullied and intimidated and threatened and sued, or threatened to be sued. It's a really long ordeal.

I first met Elizabeth when I was twenty years old and I'm thirty-two years old now, so this saga has consumed my entire adult life up to this point. I don't even know how to begin answering that question, it's just a long, painful ordeal.

Guy Kawasaki:

So with hindsight, would you do it again?

Tyler Schultz:

Yeah, I think I would do it again, I would do it very differently. I hope that if I were to go through this again that I would've learned a lot from the first go around.

But it's an interesting question because when people first started asking me that question when I was twenty-six years old, shortly after, or while I was still really in it, my answer was, "No way, I would never do this again, it was totally not worth it."

And as more and more time has passed, I'm starting to see more the positives that have come out of it, and now that the threats are totally gone, I really have been able to turn this really terrible negative experience into a positive experience. So finally at this point in my life I'm starting to say, "Yes, I would do it again, it was worth it."

Things also really worked out for me, I got extremely lucky. Yeah, so at this point I'd say I'd do it again.

Guy Kawasaki:

What factors make you now think you would do it again? What was the positives that came out of this?

Tyler Schultz:

One, I've been totally vindicated by the FDA, CMS, SEC, and now with these criminal trials by the Department of Justice, and that ultimate form of vindication took a long time to come, like I said, I'm thirty-two years old now, but did finally come.

All those threats I think are now mitigated. And I speak to tons of universities and classes, and at conferences, and I really get a lot out of those types of events. I'm always having people coming up to me afterwards saying, "I was in a very similar situation and your story inspired me to do the right thing," and that means a lot to me, it really does.

And so now I really do see the positive impact that my story has had, and I wouldn't go back in time and not do all of these things to spare myself some money and emotional damage, at this point I'd say it was worth it.

Guy Kawasaki:

If you were writing a book called Whistle Blowing for Dummies, what would your advice be for a potential whistleblower?

Tyler Schultz:

Piece of advice number one would be get a lawyer, easily, and then do what your lawyer tells you to do. If I could redo one thing it would've been I wish I had gotten a lawyer while I still worked at Theranos, because there are ways to blow the whistle a lot more responsibly than what I did.

There are protected government whistle blowing channels that you can go to. I actually tried to go through one of those whistle blowing channels initially, and unfortunately my complaint seemed to have gotten lost in the shuffle, but I wish I had a lawyer who could have really advocated for me.

When I reached out to, it's called the Laboratory Investigative Unit, it's part of the Center for Medicare and Medicaid Services, and I use a fake email and a fake name, I was trying to be completely anonymous, because I was just terrified, and really I needed a lawyer to say, "Look, you have the right to do this, and not only should you use your real name, but we're going to advocate for you, and we're going to make sure that this complaint is heard, and we're not only going to go to CMS, but we can go to the SEC." There's a lot that a lawyer could have done to help me.

Guy Kawasaki:

So right now you're in the bioassay testing-

Tyler Schultz:

Yeah, I'm still in the diagnostic business, for better or worse.

Guy Kawasaki:

So when you're out there pitching Flux, do you find you have to dig yourself out of a hole because you're tainted with Theranos and you're the Theranos whistleblower?

Or do people just say, "Wow, you got a lot of cred, we can really trust you"?

Tyler Schultz:

It's an interesting question. So actually Flux will soon no longer be a company, unfortunately.

We had a really amazing diagnostic technology that used old computer hard drive tech where you have magnets that flip up and down to store zeros and ones, and instead you have a biological reaction flip those magnets so it was very sensitive, easily multi-flexible, you could use it in point of care settings, the technology itself was really incredible, and unfortunately I really struggled to fundraise, and ultimately I had to finally make the decision to move on.

And it was a tough decision to make because I had been working with this technology for about six years.

I think that overall venture capitalists probably trusted me more than your average entrepreneur, especially in the diagnostic space, but I also think that there are some people who are really good at raising money, and I'm definitely not one of those people.

It's possible that I'm overly honest, I'm too practical, and I've been told directly to my face I need to be more like Elizabeth Holmes, because I'm not very... I've heard it many times, believe me. I'm not a really good salesperson, I'm not good at showing the big vision.

I was really good at talking about what our technology is, what we've accomplished, the papers that have been published, the data that we have, and the one thing I couldn't do was really pitch investors on this huge multi-billion dollar opportunity.

And it was really sad because I felt like I found a technology that could actually do the things that Elizabeth was claiming, and I thought the business would basically sell itself, and that was definitely not the case. Diagnostics is a brutally tough business, and it's one where investors have lost a lot of money over the years.

It's really capital intensive, there haven't been a whole lot of winners, so it's a tough space to raise money in.

But interestingly, so even though Flux is winding down, I actually did co-found another company called Healthyr, and with Healthyr we're taking a completely different approach where we're actually using the same technology that's in central laboratories, but we're using a collection device that allows people to prick their finger and collect the sample at home, and then put it in the mail and ship it to the lab.

And I think it's actually a really practical and responsible and ethical way to achieve that same vision that Theranos was going for. And I would say we're even taking it one step further because we're not in a Walgreens, you can actually do the collection at home.

Elizabeth always talked about these diagnostics being actionable information, and for us, when you get a result on your portal, right next to your results there's a button where you can click to schedule a telehealth consult and you can discuss your results with a physician who can either order follow up tests, or say, "It looks like you're pre-diabetic, or you have high cholesterol, I'm going to prescribe you some metformin or statins," which are really cheap and effective medications that can potentially save people's lives.

So long story short, still chasing the vision, I think it's a really good vision, I think there's a much better way to achieve it.

Guy Kawasaki:

I've been in Silicon Valley for, I don't know, forty, fifty years, and what I've noticed is that it doesn't matter how many times you fail, all that matters is you succeed once and then everybody forgets the failures.

Tyler Schultz:

Yeah, thanks, I appreciate that. I do feel like I've experienced a lot of failure thus far in my career. Theranos was a disastrous, flaming ball of a failure, and then Flux I think, Flux was a more elegant failure. I even had some of my investors who I spoke to as Flux was dying out and they said, "You actually did the things that you said you were going to do when you raised the seed round, and now investors aren't really buying the story you're selling, and we would love to back you again if the opportunity comes up."

So I feel like overall it's always sad when something like that dies, but it's best to just fold when it makes sense and to not go down the path that Elizabeth did where failure was not an option for Elizabeth, and so she did anything she could possibly do to not fail and that ultimately led to a massive fraud.

Guy Kawasaki:

One simplistic way of looking at it is you just saved eleven and a quarter years of your life by having that moral high ground, but I digress.

So I am curious, because one of the things that is most, I don't know, confusing to me are the two people, William Frist and William Foege.

So these guys are heart and lung transplant surgeons, and former director of CDC. How do those kind of people get snookered? I can see Henry Kissinger, he's trying to figure out Yeltsin and Gorbachev, George Schultz is dealing with George W. Bush, but these guys are in the business, how do they not see it was just a house of cards?

Tyler Schultz:

It's a really good question because I would say it wasn't that hard to see. That's the weird thing about this fraud is that it really didn't take a whole lot of special education or inside knowledge, if you roughly had an idea of what you were looking at you could look at it and say, there's no way that this can achieve the things that Elizabeth is saying. It was really obvious.

I think the problem with those people, with her board specifically, is that they wanted it so badly to be true, so badly. I think we all wanted it to be true, she had a very compelling story.

She dropped out of Stanford when she was nineteen years old, she was the next Steve Jobs, she wore the black turtlenecks, she was the youngest self-made female billionaire, and she was doing well by doing good, and it was a story we all wanted to believe.

And I think a lot of those men, they wanted to believe the story, but then they also were just infatuated by Elizabeth. And she had this personality that is able to just suck people in, and she was just incredibly good at it. She knew exactly how to, I don't know, exploit weaknesses in people's personalities, and she was able to just suck them in.

On top of that, I think the board was also overly compensated, and they wanted to become enormously, hugely wealthy, so I think there were a lot of factors at play.

Guy Kawasaki:

I think it's human nature, but it is human nature on steroids in Silicon Valley, which is this dependence on proxies, which I think at the root is because of laziness, and by this, Henry's in it, and George is in it, so it must be real.

And then they got this guy from the CDC, and then the former secretary of education is in it, and this military guys in it, so all these smart people are in it so it must be good. That's the due diligence point.

Tyler Schultz:

I think that's exactly right. There was this enormous transfer of credibility that started with the dean of chemical engineering at Stanford where he joined Theranos, and then because he joined, Elizabeth was able to bring my grandfather in.

And then once my grandfather was in they brought in the Frist and Henry Kissinger and Jim Mattis, and the list goes on and on. They had former secretaries of state, former secretaries of defense, senators, it was really astounding.

And as an investor, yeah, that means a lot, especially when you have someone like Jim Mattis on the board, who was about to become the Secretary of Defense, he's a four star general.

And on Theranos' website they said that these devices were currently being used in Afghanistan in battlefields, and there was a quote attributed to Jim Mattis on the Theranos webpage that said this.

And so if you're an investor doing diligence, who better in the world could vet that statement than Jim Mattis? And he's on the board, of course you're going to believe it. These lies were just so big that they were almost unquestionable.

One of the craziest things that came out is the SEC found an instance where Elizabeth was telling a prospective investor that their revenue the previous year was $100 million. In reality their revenue the previous year was $100,000.

That's not a rounding error, that's not wishful thinking, that is just a 1000x misstatement of your revenue.

Someone says, "My revenue is $10 million," you think, okay, maybe it's ninety million, you don't think it's $100,000.

Guy Kawasaki:

This may be perverse logical, but having seen what happened with your grandfather and Mattis and Kissinger, and all that, does it ever make you take pause and you think, okay, so the Secretary of State, Secretary of Defense, a Senator is saying, "There's weapons of mass destruction, we got to go invade Iraq."

If they're so gullible about Theranos, how do we know there's really weapons of mass destruction, or the Russians are going to invade Ukraine? Why would you believe them when they say anything? Or is it the case that you can believe them on that kind of stuff, but when it comes to biotech they're just out of their lane so just ignore what they say.

Tyler Schultz:

Oh, I've thought the exact same thing, believe me. Seeing Jim Mattis basically get manipulated by this young blonde woman, and then he becomes the Secretary of Defense, that scared me.

It was like, the safety of our country is in this man's hand, and I've seen firsthand how manipulable he is, it's terrifying. But I do think you touched on something that's important, a lot of these men were very smart and very accomplished in their field, but they just didn't know what they were looking at when it came to a medical device.

And my grandfather basically told me exactly that once, he said, "I'm over ninety years old, I fought in a World War, I negotiated the end of the Cold War, I've seen a lot in my lifetime, I know what I'm looking at, and I know this is real."

And it's a hard argument to argue against, it's yeah, everything you just said is true, still does not mean that you're right, but I can tell that you're not going to listen to me, so it's makes for a very unproductive conversation.

Guy Kawasaki:

Wow. I've heard multiple versions of this, the answer to this question, which is you did or you didn't reconcile with him before he passed away?

Tyler Schultz:

I think the reason you've heard conflicting reports is that it is a little ambiguous, and so depending on who I'm talking to, they take the ambiguity and choose to go one direction or the other with it.

So the way things ended with my grandfather, he never apologized for anything, he didn't recognize his role in this, but he did finally say that I was right, which means a lot.

So he did recognize that I was right, and he actually ultimately told me a story where he saw where Elizabeth was lying, in an instance where I didn't have to directly tell him and pry his eyelids open.

So I think he finally did come around and he started believing me.

I first came to him with my concerns in 2013, 2014, and then I was getting threatened with lawsuits in 2015, and he didn't really come around until late 2018, 2019, And then he passed away shortly later.

So by the time he came around it really wasn't helpful, and he fell pretty far short of apologizing and actually making things right. It's pretty ambiguous, so I don't know how you want to take it.

Guy Kawasaki:

So now that you're involved, first with Flux and now Healthyr, is that the right thing?

Tyler Schultz:

Yeah, Healthyr, with a Y-R on the end, so healthy.

Guy Kawasaki:

You're in a management position, have you figured out how do you deal with this dichotomy of nay saying, negativity, pessimism, versus honest feedback that we need to take into account and fix?

You don't want somebody who is just a total downer in your company, on the other hand you need to hear that the technology doesn't work. So what's the advice to a CEO?

Tyler Schultz:

I mean, you're exactly right, you need to have a balance, and I think it's important to have balanced people, and I think it's important to have different people on your team to help create that balance.

And it's funny that you say that because, like I said before, I've experienced a lot of failure thus far in my career. I've experienced a lot of positive things, a lot of growing opportunities for sure, but I haven't had that big win yet. But when I look at things, the first thing I see is the thousand ways that it fails.

I'm always looking out for, how is this not going to work and how can we get ahead of it? And I think it's important to balance out that type of attitude with the attitude of, we're going to make this work, no matter what happens, this is going to work, we're going to push through everything, we're going to be the ones that make this happen.

And I think that, I'm not the CEO of Healthyr, and I do think that the CEO of Healthyr, her name's Stacey, so I think Stacey and I have personalities that balance each other out a little bit, and she'll make fun of me and call me the Eeyore of the company, but in a very loving way.

And when we come up with our, coming up with our product ideas, there have been times when I've just told her, "I know you really want this to be a product we move forward with, but it just doesn't make sense because of X, Y, Z," and she listens to me, and that's nice.

It's nice to have that person who is super high energy and super, "This is going to happen, we're going to make it work," but they can also listen to someone like me and say, okay, this is not the best path forward, this is not what we're going to do, we're going to adjust, we're going to find a different path, a different product, and yeah, it's been good finding that balance.

Guy Kawasaki:

There are many allusions to Elizabeth Holmes wanting to be, or thinking she was the next Steve Jobs, and I worked for Steve Jobs. I don't want this to be a Dan Quayle moment, I am not a Steve Jobs, I work for Steve Jobs. And I will tell you, I read the book, and every two pages somebody delivers her bad news and he or she's fired.

And I double checked with somebody who worked with me in the Macintosh division, we cannot come up with an instance where someone went to Steve and said, "You know what? The operating system is buggy," or, "That disc drive won't work," or, "We're making the architecture wrong," and the person got fired by Steve Jobs. There's no similarity between Elizabeth having no tolerance for negativity and Steve's tolerance for negativity.

Now, when you went to Steve and said there was a problem, you damn well better be right.

Tyler Schultz:

Yeah.

Guy Kawasaki:

Don't get me wrong, he wasn't singing Kumbaya, holding hands, wearing Birkenstocks and being all lovey-dovey, but I don't ever remember him firing somebody for bringing-

Tyler Schultz:

To that I would say that I think Elizabeth emulated the appearance of Steve Jobs more than she really emulated his values, and she wanted other people to perceive her as Steve Jobs more than she actually wanted to be like Steve Jobs.

She wanted to walk the walk, she wanted to be perceived as Steve Jobs. Obviously I never knew Steve Jobs, but I've spoken to a few people who did know him, and I have not seen a whole lot of similarities.

Guy Kawasaki:

Other than the turtleneck.

Tyler Schultz:

The black turtleneck, yeah, and the dropping out.

Guy Kawasaki:

Yeah, that you can get at the Gap. You ever wonder what was going through the minds of people in the lab who didn't blow the whistle, but knew something was wrong and resigned, because arguably, if you had not done what you did, this charade would've gone on longer and literally people could have died.

When you look back, was resigning, perhaps in protest, enough, or should they have taken the next step and done what you did?

Tyler Schultz:

So we had seen instances where people did speak up. Like you say, when you read the book, it was like every two pages somebody disagreed with Elizabeth and was fired. And that was not lost on the employees, that wasn't something that was hidden, we were very well aware of this feedback loop, and people saw, you speak up, you get fired.

And in some cases, even worse, in some cases those employees were then sued. And when Theranos sued former employees they sent out a company wide email about it basically saying, "We will sue you too, this is not an empty threat, we will follow through with these NDAs and we will sue you." And so people were just terrified.

And I definitely don't hold anything against my coworkers who did not speak up. In a lot of ways it's something that, in good conscience, that I could not recommend to a friend that they do what I did.

A lot of people had mortgages and kids and visas that were dependent on working at the company, but definitely is a path that comes with a lot of self-sacrifice, and I think it's acceptable that in these situations some people look after their own self-interest. I really do think that's okay.

Guy Kawasaki:

I read an NPR thing about how after the sentencing it said that you were, rejoicing might be too strong a word. So where are you mentally? Okay, you're vindicated, but are you doing back flips, drinking champagne? Or you're just saying, oh God, thank you very much, let's just get this part out of my life and I want to go do something.

Tyler Schultz:

Yeah, thanks for bringing that up, actually, I do think that was taken a little bit out of context, as I've learned most things end up getting, or many things end up getting taken out of context.

But basically, when she was convicted, my parents called me that morning and they said, "Regardless of what happens, we're popping champagne tonight because this is over, this is finally a huge thing that is, a terrible thing that will finally be behind us after today. Whether she's not guilty or whether she's guilty, we're going to celebrate, we need to take a deep breath and feel like this is finally off our chest, and come home and enjoy that feeling with us."

And she was convicted guilty, and I went home, and we had a really great night with my family and my family friends, everyone came over and just congratulated me.

Her being convicted in a criminal court of law was the ultimate form of vindication for me, ultimate form. And so for me, it did feel like a win.

But then when her sentencing came around, I was expecting to have that same feeling again, and that is not how I felt. I got no enjoyment out of thinking of Elizabeth sitting in a prison cell for eleven years.

I think it's well deserved, the judge said the sentencing guidelines would put her between eleven and fourteen years, so she got the lightest end of the sentencing guidelines. But I don't get any joy out of Elizabeth's suffering, I did get some joy out of being vindicated though.

And I'll also say that it's just a sad situation with her kids, and it also brings up a lot of bad memories with me and my grandparents, and the suffering that me and my parents went through, so her sentencing, it was just sad. Even though it's-

Guy Kawasaki:

It's not like her punishment can undo your pain.

Tyler Schultz:

Right.

Guy Kawasaki:

The two are orthogonal at best.

Tyler Schultz:

Yeah, no, that's exactly right, her punishment does not undo my pain. But for me, I'm just glad that it's over, and I'm glad the sentencing is behind us.

She has a hearing about her restitution still coming up, and Sunny still has his sentencing, so it's not completely over, but this did feel like a huge chunk of it is now behind us, and the book is almost closed. This close.

Guy Kawasaki:

Let's just say that she appeals, it takes two years for the appeal to come to court, or whatever, and in every photo she's holding two kids, and she gets a book deal for five-million-dollars to tell her side of the story, and now she's saying, "Oh, I've seen the light, maybe even starts another biotech firm. What do you say? You say, "Only in America," or do you say, "What the fuck?" What do you say when that, that's a scenario that could happen, right?

Tyler Schultz:

Not only that, I almost think it's inevitable. She's not just going to go to prison and then reenter society quietly, she's just not that type of person.

She's going to have some form of a second act, and she'll undoubtedly convince a lot of people that, I don't even know how to say this. She's really good at putting on a show, she's really good at presenting an image of herself, and she will strike the perfect balance in order to win people back over.

It'll be a perfect balance between remorseful and overcoming adversity, and I don't know, being a loving mother, and being brilliant in some respect. She's going to do it, and she's going to convince a lot of people. She's going to have a lot of people on her side, I'm afraid.

Guy Kawasaki:

Maybe Andrew Newman and her can start a company together. That would be the perfect combination, funded by Elon Musk, that's the dream team right there.

Tyler Schultz:

Yeah.

Guy Kawasaki:

It is a fricking amazing story, oh my God.

Not only is it only in America, it's only in Silicon Valley could this happen. Just remarkable, to use a word.

I need to get some thoughts about how people listening to this can apply this to their lives, so question number one is, how do you spot this kind of bullshit? How do you spot a bullshit CEO, a bullshit company?

Tyler Schultz:

That's a tough question, I think it's pretty tough.

I think the problem is that human nature gets in the way. We want to believe people that we are attracted to in some way, attracted to their story, attracted to their ideals, attracted to their charisma or the way they speak, and oftentimes that masks a lot of truth.

And because we are human, it's really hard to see past those types of things that we're attracted to. So as best you can, try to remove personalities from what you're looking at and just evaluate a company or a technology just based on the technology, or whatever metric you have to evaluate the company. And it sounds easy but it's much, much a tougher, much easier said than done.

Guy Kawasaki:

Part of it is a self-selection process, but you only hear... I guess that's not true, because we know about WeWork, and we know about our friend in crypto, and we know about Theranos, so we definitely know about the spectacular failures.

But people told Steve Jobs that what he was going to do was impossible, and people told Fred Smith at FedEx, every big success story there's always this, everybody says it can't be done, nobody wants an electric car, there's no infrastructure.

I don't know the answer either, I don't know when you believe and when you doubt, which is, I guess maybe that's why it's hard to be an entrepreneur.

Tyler Schultz:

Yeah, it's tough. Yeah, it's hard to see.

I would also add that a lot of times people, like you said, have these crazy ideas that feel like this could never work, and then it works. And then the problem is that person internalizes that, that entrepreneur internalizes that, when everyone tells me I'm wrong, I'm right. And that, I think, can become pretty dangerous.

And it's the same thing we saw with the Theranos board, it's that whole, I fought in a World War, I negotiated the end of the Cold War, I can never be wrong type of mentality.

And ego, ego is a dangerous thing, and I think there are a lot of Silicon Valley CEOs that end up with enormous egos because, in a lot of ways, in a lot of ways they've gotten lucky, they had crazy ideas that worked.

There are a lot of crazy ideas that don't work, but some of them do work out, and those people then might think that they're a lot smarter than they actually are, and then get into spaces that they may not be as familiar with thinking that they can't be wrong, and then bad things could happen.

Guy Kawasaki:

Well, the Silicon Valley entrepreneurial way is to say that just because people say you'll fail doesn't mean you'll fail, but very few people think about it the other way, which is just because people say you'll fail doesn't mean you'll succeed either.

Tyler Schultz:

Yeah.

Guy Kawasaki:

And they never think about that. All these crypto pros pretend the last three weeks didn't happen, but when you talk to crypto pros, and you express negativity about crypto, they always tell a story like, people doubted that the internet would be big too, and crypto's like the internet, you can doubt it, but it's going to be successful and you're going to miss the boat.

Tyler Schultz:

The logic makes no sense.

Guy Kawasaki:

Yeah. For a while people thought that the most valuable thing in the world was tulips.

Tyler Schultz:

Yeah.

Guy Kawasaki:

That didn't work out either.

Tyler Schultz:

That's exactly right.

Guy Kawasaki:

Tyler, I got to tell you, man, for a person of thirty, you sure have had some interesting experiences.

Tyler Schultz:

Yeah.

Guy Kawasaki:

And I'm sorry you had to sleep with a knife, but at least I'm one person in Silicon Valley who deeply admires what you did.

Man, you have steel balls, man, that took courage, I really admire what you did.

Tyler Schultz:

Yeah, thanks, I really appreciate that. So yeah, hopefully now I can take all these, I've learned too many lessons to count, hopefully I can take all those lessons and apply them to Healthyr and finally get that big win.

Guy Kawasaki:

I just thought of something, I'll make you an offer that you can refuse, which is I like you so much and I admire what you've done so much. I have to be immodest for a second, I know how to pitch. I've literally written the book on how to pitch.

So I offer you free, no options, nothing, you don't have to give me nothing, you gave me this gift of this interview already, but I will be happy to meet with you and the CEO of Healthyr and offer you feedback on your pitch, if you ever want that.

Tyler Schultz:

We would very much appreciate that.

Guy Kawasaki:

Okay.

Tyler Schultz:

Yeah, that'd be great.

Guy Kawasaki:

We don't have to meet on the campus of Stanford, we don't have to hide from the Boies Schiller tails, we can meet and we'll really stick it in their faces, we can meet at Bucks in Woodside.

Tyler Schultz:

Okay, yeah, that'd be fun.

Guy Kawasaki:

Seriously, I offer you that, you just let me know, I'll be happy to do that. It would be an honor and a privileged to do that.

Tyler Schultz:

That would be awesome, yeah, I'll definitely take you up on that.

Guy Kawasaki:

We are releasing this episode on December seventh. We timed it this way because today is the day that Sunny Balwani, the other defendant in the case, is being sentenced.

We recorded this episode on November twenty-third. We don't know what the sentence will be yet, but if Elizabeth Holmes got eleven and a quarter years, you can be pretty sure that Sunny is going to have a stiff sentence too.

You would think that what you just heard about is a novel or a movie, but it really happened, only in America, only in Silicon Valley.

Tyler Shultz should be honored, commended, and admired for doing what he did, at great cost, at great risk.

Someday, if you're running a company, you should never, ever put people in the position where they might have to blow the whistle.

And if you are someone who's working for a company that is doing something fraudulent, admittedly this is easy for me to say, but remember the example that Tyler Shultz provided us today, he did the right thing.

I'm Guy Kawasaki, and this is Remarkable People. My thanks to two surfing buddies, Mark Nishimura and Jen Crock. Without their help this interview would not have happened.

My thanks to the Remarkable team, Jeff Sieh, Peg Fitzpatrick, Shannon Hernandez, Madisun drop-in Queen of Santa Cruz Nuismer, Alexis Nishimura, college applicant, and Luis Magaña college graduate.

Remember, once you start lying, it's very hard to stop lying. Eventually you may end up in prison.

Remarkable People don't lie, and they don't end up in prison. On this pleasant note, let me bid you a fond Mahalo and Aloha.

Sign up to receive email updates

Enter your name and email address below and I'll send you periodic updates about the podcast.

Leave a Reply